property tax on leased car in ct

A Bill of Sale from the leasing company indicating the sales tax on the buyout option was collected. Complete Edit or Print Tax Forms Instantly.

Connecticut Bill Of Sale Templates And Registration Requirements

However the bill is mailed directly to the leasing company since leased cars are registered in the companys name.

. In other words if you sell 1000 worth of property you must pay 1 for every 1000. The short story I got a K5 GT on lease in 2021 waited forever to get it picked it up April 5th then we had a flood officially a disaster in which. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the dealer.

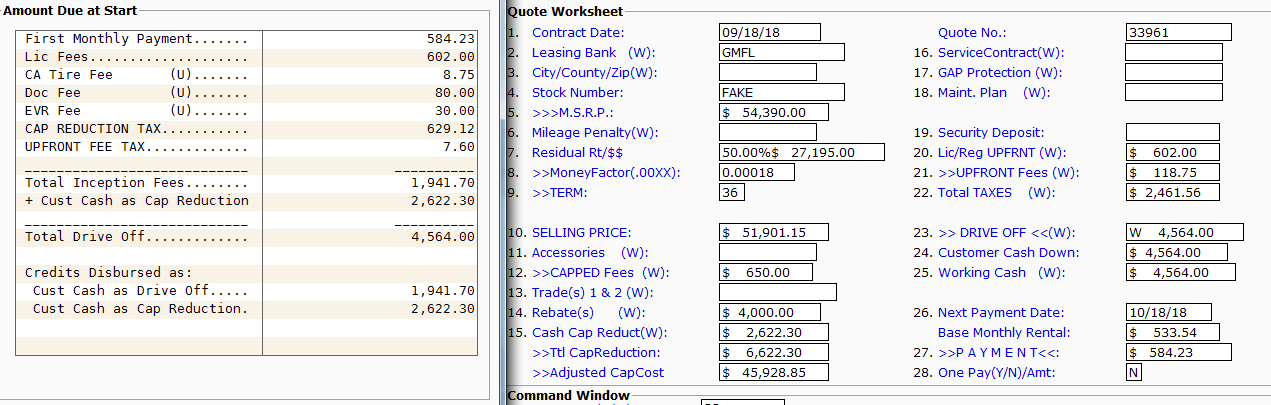

If your vehicle was purchased from a licensed dealership the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price. For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the dealer.

There are different mill rates for different towns and cities. If personal property taxes are in effect you must file a return and declare all nonexempt property. I live in Hartford ct and my mil rate here is 7429.

All tax rules apply to leased vehicles. Connecticut residents who own or lease vehicles are required to pay local property taxes. Connecticut car owners including leasing companies are liable for local property taxes.

Some build the taxes into monthly. The payments were good but no personal property tax was included in the lease payment. We allow full trade-in credit when.

Some build the taxes. A Federal Odometer Statement properly completed by the leasing company. Download Or Email CT DRS More Fillable Forms Register and Subscribe Now.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or. If you terminate your lease it. Ct Property Tax On Cars Credit.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or. Although leasing companies pass on the taxes to lessees they do so on a leasing basis. Connecticut will charge 70 of the vehicles value.

Which means I would have to pay. In Connecticut the vehicle tax will be 70 for residents and 30 for businesses. The mill rate for car tax is computed to be 70 for residents and 30 for businesses.

Connecticut car owners including leasing companies are liable for local property taxes. Leased Car Property Tax After Total Loss in Ida. Unfortunately the state of RI taxes everything associated with an auto.

This could include a car which in most households is a relatively valuable property. After receiving an estimate of his municipal property taxes Sergienko was. If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based.

Most leasing companies though pass on the taxes to lessees. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. Most leasing companies though pass on the taxes to lessees.

Ad Access Tax Forms. The taxing process for motor vehicles is the same for other taxable property in Connecticutthe tax rate of the property is assessed at 70 of fair market value which is. They will pay the bill when it is received and then they will charge you the actual amount of the tax.

After receiving an estimate of his municipal property taxes Sergienko was.

401 W Main St Norwich Ct 06360 Loopnet

19 Chesterfield Rd East Lyme Ct 06333 Loopnet

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Used Cars In Hartford Ct For Sale Enterprise Car Sales

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Is It Better To Buy Or Lease A Car Taxact Blog

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

3091 S Jamaica Ct Aurora Co 80014 Loopnet

Buildings Action Business Brokerage Llc And Elm Realty Advisors

When Should You Lease Your Car Here S The Best Time To Do It Shift

How To Buy A Leased Car 15 Steps With Pictures Wikihow

Free Connecticut Bill Of Sale Forms 3 Pdf Eforms

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Tangible Personal Property State Tangible Personal Property Taxes

Bmw Lease End Information Bmw Usa

Connecticut Leasees Property Taxes Off Ramp Forum Leasehackr